The chain of title is the listing of previous as well as current proprietors of a residential or commercial property in chronological order, from the initial owner to the here and now proprietor. A bequest is personal effects or money that is offered as a gift via a will. Use the menu listed below to navigate our glossary of mortgage terms alphabetically. We make every effort to supply you with information about product or services you could discover interesting as well as useful. Relationship-based ads and also on the internet behavior advertising assist us do that. We ask for your e-mail address to ensure that we can call you in case we're incapable to reach you by phone.

Unlike the security of fixed-rate loans, variable-rate mortgages have rising and fall rate of interest that can go up or down with market conditions. Numerous ARM items have a fixed rates of interest for a couple of years prior to the car loan adjustments to a variable rates of interest for the remainder of the term. For instance, you could see a 7-year/6-month ARM, which indicates that your price will certainly stay the exact same for the initial 7 years and also will certainly change every 6 months afterwards first period. If you consider an ARM, it's vital to review the fine print to understand just how much your price can increase as well as just how much you might end up paying after the introductory duration ends. USDA finances-- USDA car loans help moderate- to low-income consumers acquire residences in backwoods.

- As soon as your deal has actually been accepted, there's a bit much more work to be done to settle the sale as well as your financing.

- A completely amortizing home mortgage is a finance in which both major as well as passion are paid fully with arranged installations by the end of the finance term.

- Among other points, the QM policies require lenders to make certain debtors have the monetary capacity to repay their mortgage on schedule.

- Whether your loan provider will certainly require you to pay for private home mortgage insurance.

When you obtain a variable-rate mortgage, it's important to check out the disclosures carefully to establish just how high your repayment might go. If that amount is not affordable to you, see to it you recognize the threat involved in obtaining an ARM. Remain in the know with our latest residence stories, home loan prices as well as re-finance tips. The lending institution offers you credit to cover your closing costs for a greater rate.

During the earlier years, a greater portion of your payment approaches passion. As time goes on, even more of your repayment goes toward paying for the equilibrium of your financing. Non-conforming car loans consist of government-backed home mortgages, jumbo and also non-prime mortgages. A lending institution is a financial institution that finances you money to purchase a house. Your lender might be a bank or lending institution, or it could be an on the internet home mortgage firm like Rocket Home mortgage ®.

What Is The Adjusting Lending Limitation In 2020?

The equilibrium is the full buck amount of a loan that is left to be paid. It amounts to the loan amount minus the sum of all prior repayments to the principal. Refinancing is normally done to safeguard much better loan terms, such as a reduced rates of interest.

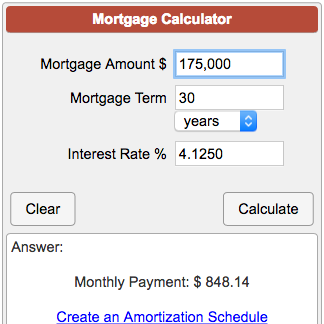

Optimum Month-to-month Settlement

You need to examine your proceeding capacity to pay off as conditions change with time. The LTV limitations do not put on debtors in negative equityapplying for a mortgage for a new building. However, lending institutions might still opt to apply more stringent financing standards, based upon their evaluation of each situation.

Negative Amortization Funding

You need to locate a way to return on track and start making your home loan payments once more prior to the moratorium initiated by your home loan insurance coverage mores than. Personal Home loan insurance coverage, on traditional car loans may be consisted of in your month-to-month repayment if you are placing much less than 20% down. FHA and also USDA need a monthly mortgage insurance coverage payment, which will be included in your total month-to-month repayment. If you are light on funding or have a lower credit score, an FHA finance might be an excellent fit for you. FHA car loans can also profit an individual who has had a recent derogatory credit scores occasion such as foreclosure, bankruptcy, or a brief sale. If the customer requires help in certifying, FHA fundings allow relatives authorize as non-occupant co-borrowers as well.